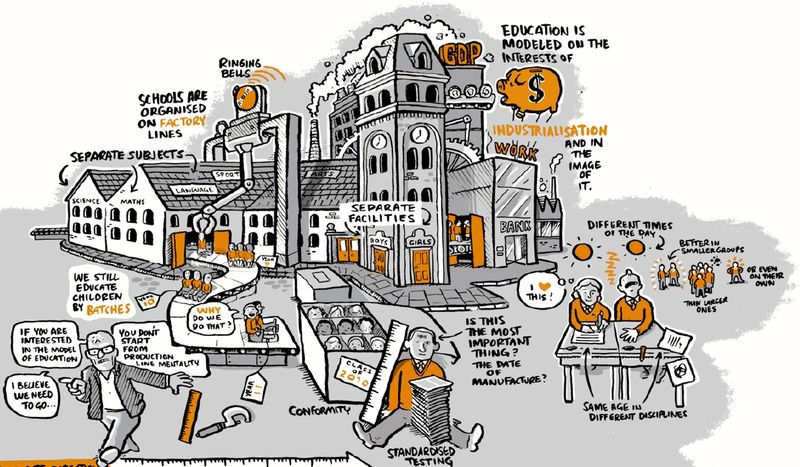

Homeownership has long been seen as an essential feature of the American Dream, in which equality of opportunity is available to any American. The current housing crisis is long in the making and illustrates how external events expose the fragility of the American Dream.

The 2008 housing bubble caused a pause in construction, a buying spree of foreclosed properties by private equity firms, and stricter regulations from banks related to mortgages. These events set the stage for private equity firms to begin to expand their influence in the rental housing market as they aimed for high returns. With a lack of regulations for rent control, rents have gone up quickly in recent years – more than 20% per year in some cities in the USA – when property prices started to rise. The COVID-19 pandemic has created an additional pressure. New home construction got delayed due to supply chain problems and labor shortages, while demand for bigger houses (for working from home) is rising. With reduced profitability of commercial real estate (empty offices and shopping centers), investment firms began to focus even more on the residential housing market.

Affordable housing is now a major challenge, especially for new entrants to the housing market. The provision of housing is increasingly carried out by distant investment firms who are less involved with the local issues. From our work on coupled infrastructure systems, this is a red flag since with an increased distance between users and providers there is a potential decline of involvement and lack of understanding of local needs, and an increased risk of low performance of the infrastructure. This is nicely illustrated in a recent item in 60 Minutes where houses for rent were shown as providing a solution to starters on the housing market. Houses are bought by investment companies without inspection, and a cookie cutter fix up is done to make it available for rent.. One could rent the American Dream as the investor claimed in the video, but the renters miss out on the benefits of home ownership and will fall financially behind in the long term.

The increasing provision of the rental housing stock by global private equity firms who aim at high returns is a major problem for the renters, especially with a lack of legislation to guarantee affordable housing. Those big players are likely also have a major influence in preventing that regulation will be implemented which could reduce their profitability. This is another example of what Robert Reich refers to as the shift from stakeholder capitalism to shareholder capitalism. The genie is out of the box and governments at different levels have to consider how to provide protection for renters, and allow starters on the housing market to purchase a house.